How it Works

1. Analyze

Connect Loan Asset Data

Track Assets and Portfolios

1. Analyze

- Connect loan data via API or direct file upload

- Setup portfolio preferences such as asset composition, risk assumptions, hurdles and KPIs

- Track and update your risk-performance data periodically tracking which loans to tokenize, and which tokens to service

- Setup portfolio preferences such as asset composition, risk assumptions, hurdles and KPIs

- Track and update your risk-performance data periodically tracking which loans to tokenize, and which tokens to service

2. Tokenize

Structure Investment Offerings

Issue Tokenized Products

2. Tokenize

- Define investment products to be issued by selecting templates or compose your own, such as :

direct participations (syndicate), single and multi-fund (units),

and structured notes (securitize)

- Issue tokenized investment products onto a dedicated Enterprise Blockchain DLT network for distribution

direct participations (syndicate), single and multi-fund (units),

and structured notes (securitize)

- Issue tokenized investment products onto a dedicated Enterprise Blockchain DLT network for distribution

3. Monetize

Distribute Your Products

Manage Token Lifecycle

3. Monetize

- Distribute tokenized investment products for sale

to qualified investors in existing network or in extended interoperable avenues

- Manage token post-issuance lifecycle such as trading, holdings and payouts, processed per defined servicing flows, mandate and fee structure

to qualified investors in existing network or in extended interoperable avenues

- Manage token post-issuance lifecycle such as trading, holdings and payouts, processed per defined servicing flows, mandate and fee structure

Wallet

Management

Hold and Transact

Assets and Payments

Assets and Payments

Wallet

Management

Track and manage transactions and balances for any form of credit, tokenized as a programmable asset

Request more info Asset

Management

Track Credit and Loan

Portfolio Management

Portfolio Management

Credit Asset

Management

Service and manage the lifecycle of any form of loan product, credit asset, and portfolio of assets

Request more info Fund

Management

Collective Investments

Fund

Management

Customize and issue fund products and run end-to-end fund operations digitally

Request more info Marketplace

Operation

Managed Venues

Marketplace

Operation

Setup and manage unique digital venues for the buying and selling of assets

Request more info Securitization

Management

Structured Investments

Securitization

Management

Issue structured investment products backed by any credit asset or pool of assets

Request more info

Benefits of Tokenization

with InState OS

Financial

Increase Liquidity

Access Untapped Capital

Financial Benefits

- Increase liquidity through broader distribution networks and secondary trading

- Access untapped pools of capital through fractionalization, lower minimum investments and broader distributions - incl retail

- Access untapped pools of capital through fractionalization, lower minimum investments and broader distributions - incl retail

Operational

Flexible Investment Products

Automated Management Flows

Operational Benefits

Issuing programmable assets and automated business process execution flows

- Allows you to issue and scale more flexible products

and

- Reduces operational overhead per AUM

- Allows you to issue and scale more flexible products

and

- Reduces operational overhead per AUM

Analytical

Transparent Data Visibility

Powerful Risk Decisioning

Analytical Benefits

Tokens are embedded with relevant data to drive InState OS risk intelligence tools

Improving the ability for both issuers and investors to make decisions about what to hold, issue, buy or sell

Improving the ability for both issuers and investors to make decisions about what to hold, issue, buy or sell

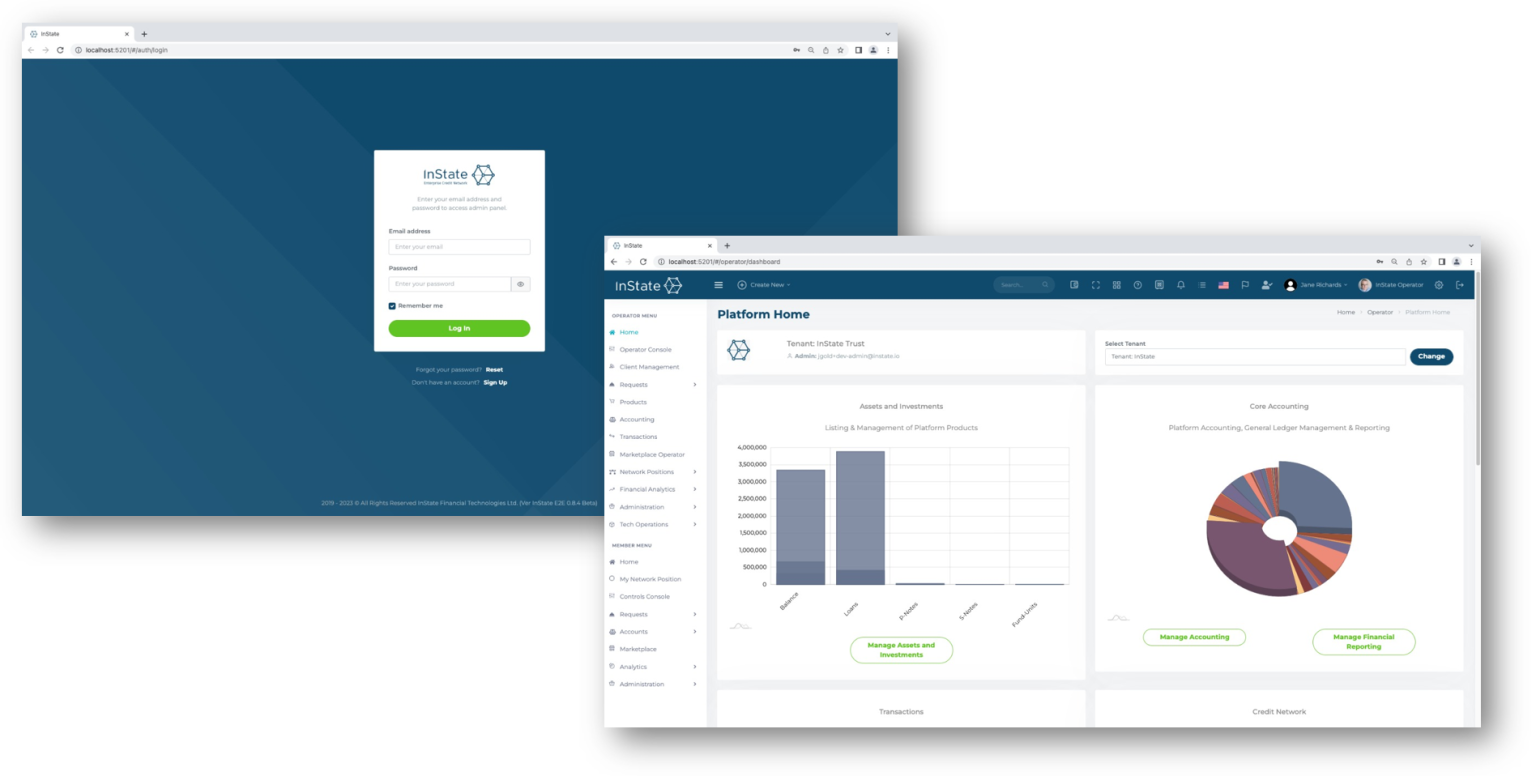

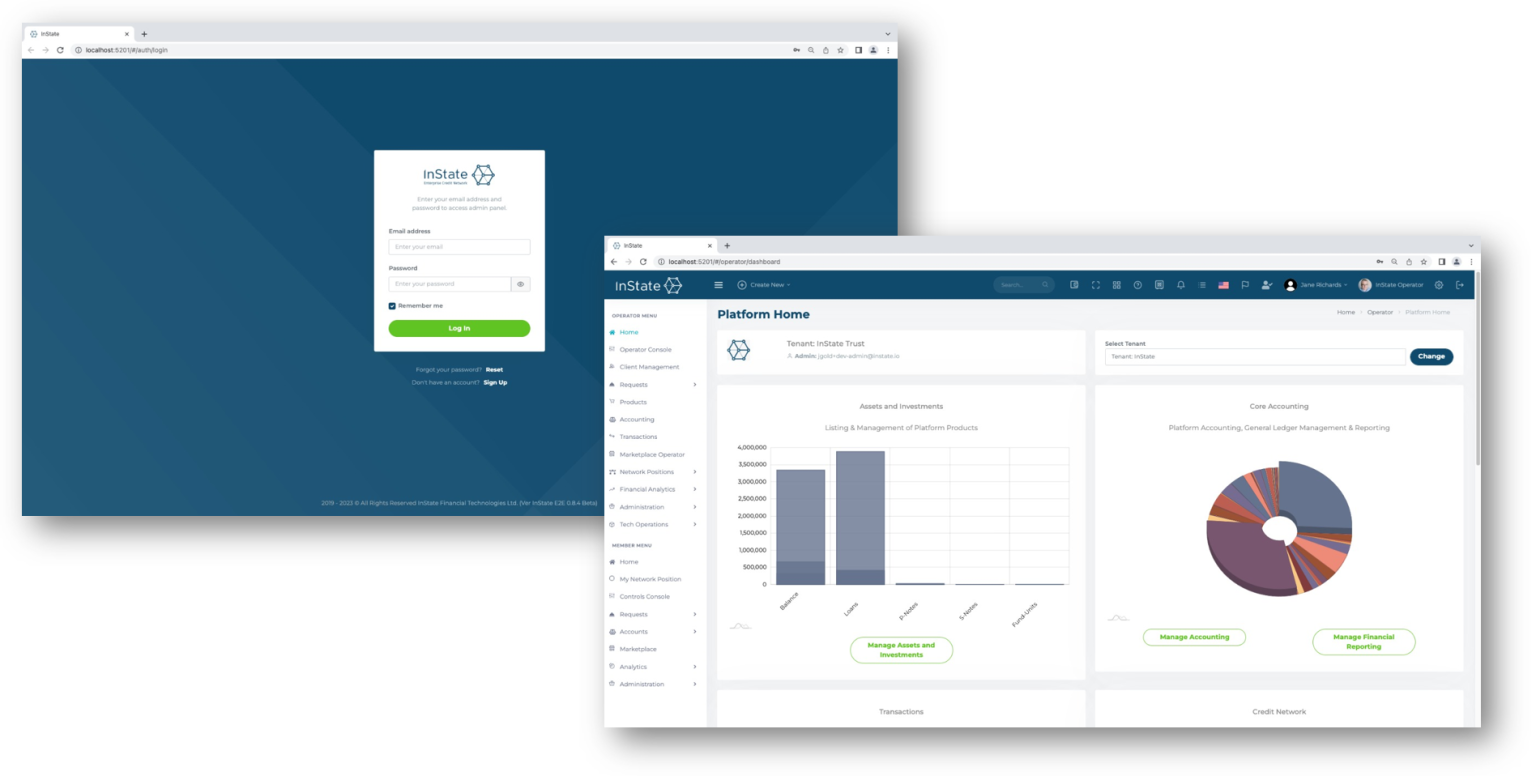

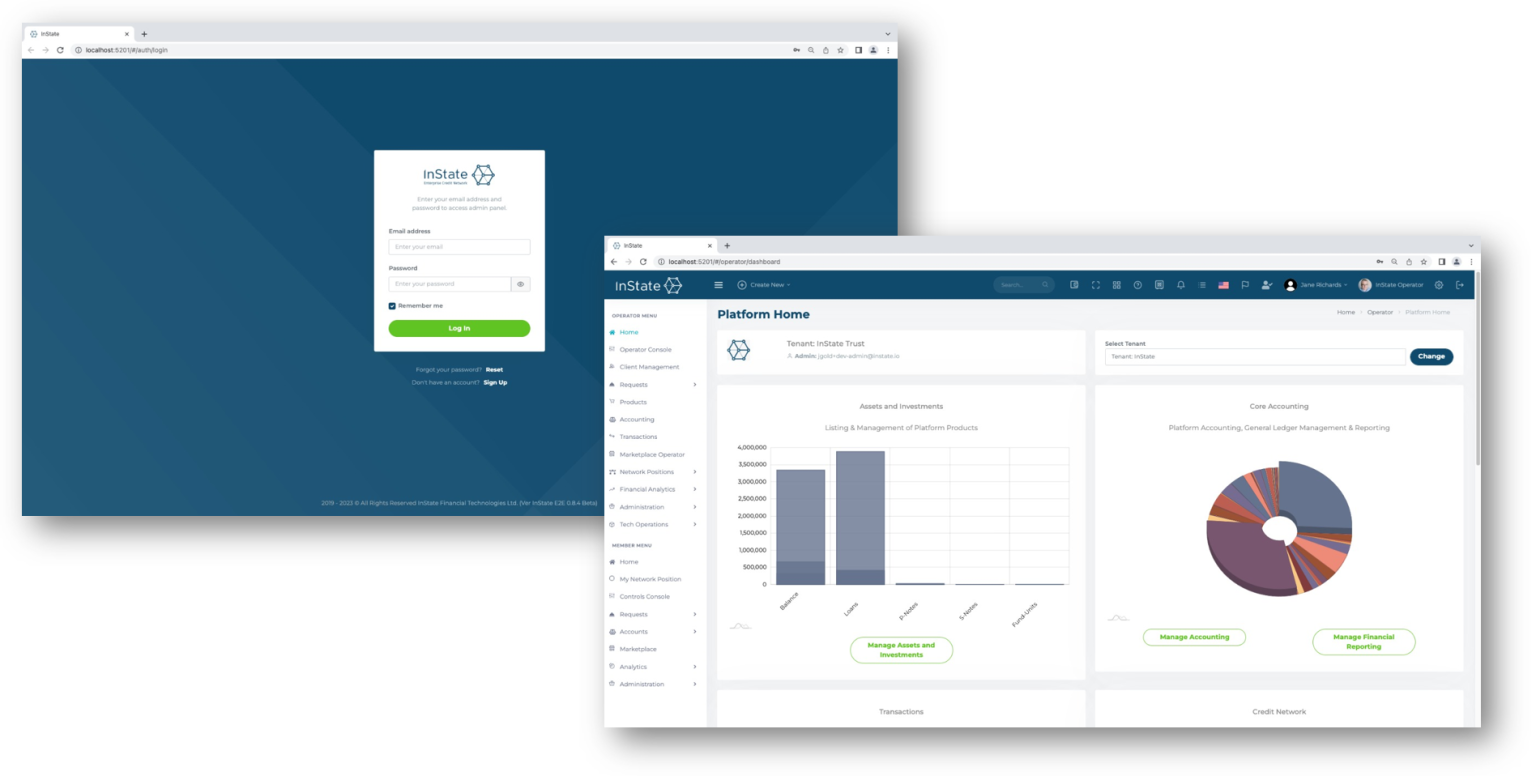

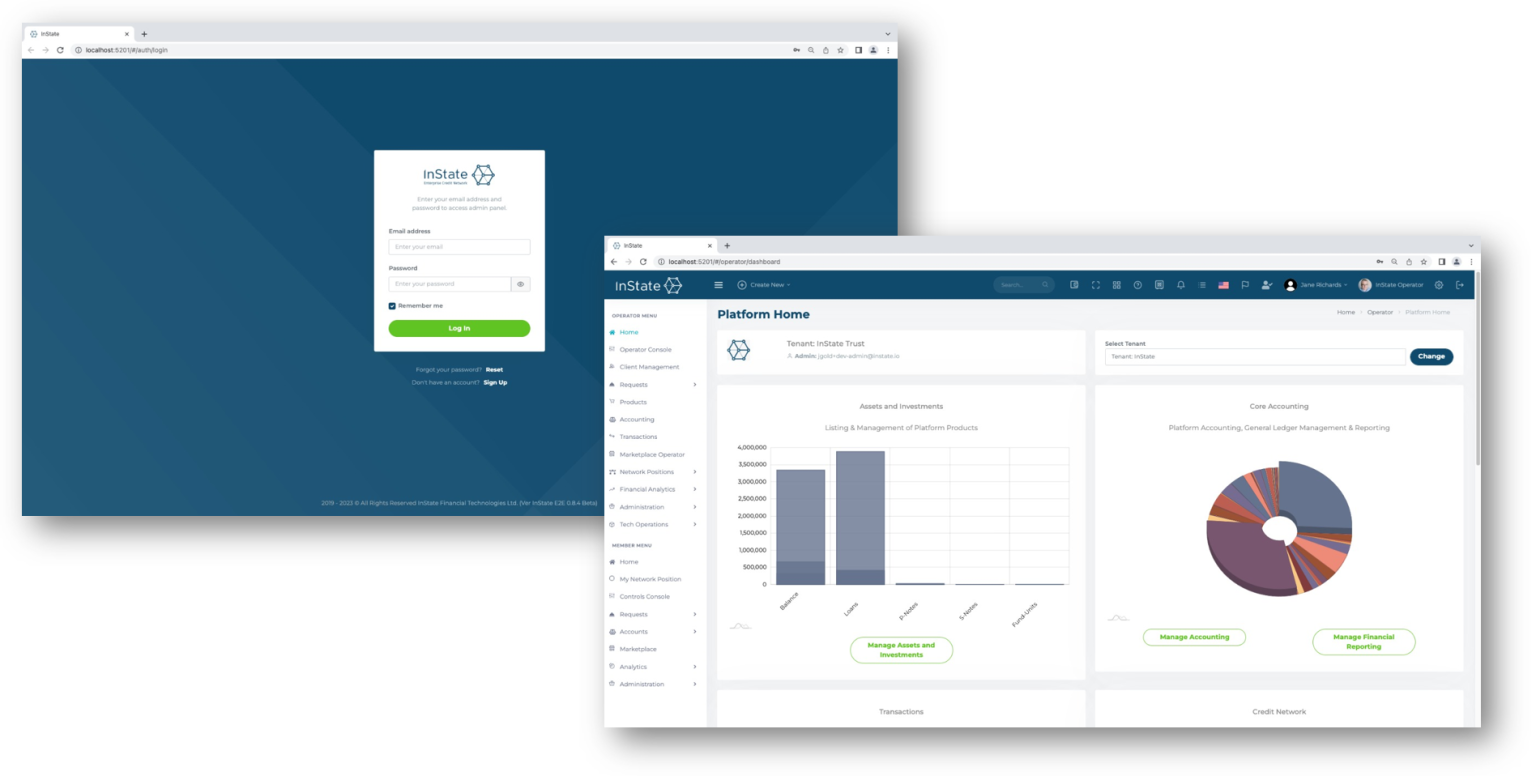

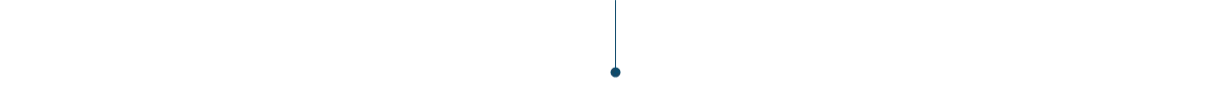

InState OS

Operating Software

InState OS

- Financial Operating System

InState OS powers intelligent and frictionless financial operations for all credit strategies and investment products

InState Network

Credit Marketplace

InState Network

- Managed Marketplace

InState Network is a tech-driven private credit market that facilitates business funding, payments, and investment transactions in an efficient, transparent and equitable way

InState OS

Private Credit

Operating System

Operating System

InState OS

- Financial Operating System

InState OS powers intelligent and frictionless financial operations for all credit strategies and investment products

Tokenize

your Strategy

Deliver compelling fund products

for any private credit use case

Business

Credit

Business Credit

- Some Use Cases

- Direct Lending

- Embedded Finance

- Trade Finance

- Asset-based Finance

Consumer

Credit

Consumer Credit

- Some Use Cases

- Secured or Unsecured

- Mortgage and HELOCs

- Loan Marketplaces

- BNPL, Embedded, BaaS

Commercial

Real Estate

CRE Credit

CRE Credit

- Some Use Cases

- Residential or Industrial

- Senior, Mez or Junior

- Syndications

- Funds of Funds

Infrastructure, Project, Asset

Based - Credit

Project Credit

- Some Use Cases

- Renewable Energy

- Infrastructure Debt

- Specialty Lending

- Syndications

Building Blocks

of InState OS Tokenization

Wallet

Management

Hold and Transact

Assets and Payments

Assets and Payments

Wallet

Management

Track and manage transactions and balances for any form of credit, tokenized as a programmable asset

Request more info Asset

Management

Track Credit and Loan

Portfolio Management

Portfolio Management

Credit Asset

Management

Service and manage the lifecycle of any form of loan product, credit asset, and portfolio of assets

Request more info Fund

Management

Collective Investments

Fund

Management

Customize and issue fund products and run end-to-end fund operations digitally

Request more info Marketplace

Operation

Managed Venues

Marketplace

Operation

Setup and manage unique digital venues for the buying and selling of assets

Request more info Securitization

Management

Structured Investments

Securitization

Management

Issue structured investment products backed by any credit asset or pool of assets

Request more info

Feature Sets

Integrated accounting, analytics, and administration

in a single private credit tokenization platform

Product

Operations

Enterprise Credit

Operating System

Operating System

Core Platform

Functionality

Flexible

UI's and Dashboards

Financial Product

Management

CustomizableLedger and Transactions

Asset Tokenization

and Fractionalization

Powerful

Tools and Insights

Client Account

Management

Automated

Front, Middle and

Back Office Flows

Analytics

Engines

Data-driven

financial insights

financial insights

Analytics

Engines

Borrower Risk Analytics

- Creditworthiness and borrowing intelligence

- Financial performance and liquidity insights

Credit Portfolio

Risk Analytics

- NAV insights and

credit risk intelligence - Liquidity and cash flow forecasting

Investment Portfolio

Analytics

- NAV insights and

investment risk intelligence - Allocation and liquidity optimization

Core

Functionality

Enterprise Credit

Operating System

Operating System

Core Platform

Functionality

Flexible

UI's and Dashboards

Financial Product

Management

CustomizableLedger and Transactions

Asset Tokenization

and Fractionalization

Powerful

Tools and Insights

Client Account

Management

Automated

Front, Middle and

Back Office Flows

Analytics

Engines

Data-driven

financial insights

financial insights

Analytics

Engines

Borrower Risk Analytics

- Creditworthiness and borrowing intelligence

- Financial performance and liquidity insights

Credit Portfolio

Risk Analytics

- NAV insights and

credit risk intelligence - Liquidity and cash flow forecasting

Investment Portfolio

Analytics

- NAV insights and

investment risk intelligence - Allocation and liquidity optimization

Underwriting

Tools

Risk pricing, monitoring

and decisioning

and decisioning

Underwriting

Tools

Automated

Underwriting

- Risk-based pricing

- Intelligent decisioning

- Loan and investment underwriting

Asset Portfolio

Monitoring

- NAV and risk monitoring

- Credit risk intelligence

Credit Risk

Management

- Structuring and enhancement

- Liquidity optimization